Liquid Mutual Fund

Liquid Mutual Fund

What is Liquid Fund?

Liquid funds are open-ended debt mutual fund schemes under the “Liquid Fund” category. They invest in debt and money market securities that mature within 91 days.

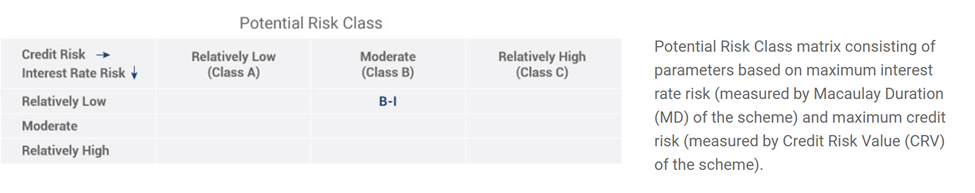

Liquid funds have relatively lower interest rate risk and moderate credit risk (Potential Risk Class BI).

Liquid Funds offer high liquidity, i.e., your money can be redeemed on a T+1 basis. They are considered the least risky among all classes of debt funds as they primarily invest in high-quality fixed-income securities that mature within 91 days. Therefore, liquid funds are suitable for risk-averse investors.

What are the underlying instruments of liquid funds?

As per SEBI mandate, liquid funds must invest in debt or money market instruments that mature within 91 days. Liquid mutual funds usually invest in money market instruments like Treasury Bills (T-Bills), Tri-Party Repos (TREPs), Commercial Papers (CPs), Certificates of Deposit (CDs), and Collateralized Lending & Borrowing Obligations (CBLO).

Investment strategy for Liquid Fund

The focus of a liquid mutual fund is to provide relative safety of capital and high liquidity to investors. So Liquid funds invest in high-quality debt securities such as bonds, debentures, and Government Securities and money market instruments such as treasury bills, commercial paper, and certificate of deposit, including repos in permitted securities of different maturities, to spread the risk across different kinds of issuers in the debt markets.

It maintains an average portfolio maturity of 1 to 3 months, thus reducing re-investment risk and providing adequate liquidity.

A Liquid Fund avoids investing in low credit-rated debt securities that may provide higher yields but compromise on safety and liquidity.

How much return can you expect from liquid funds?

Since liquid funds invest in instruments maturing within 91 days, the returns are lower than those of debt funds investing in instruments of longer maturities, e.g., short-term, low-duration, ultra-short-term, etc. However, the return in liquid funds is usually higher than in overnight funds, which invest in overnight securities. In normal circumstances, liquid fund returns are higher than your savings bank account interest rate. Therefore, liquid funds are used for parking surplus in the bank account, which earns lesser returns.

How to invest in liquid funds?

Investors who find it suitable should become KYC compliant to invest in liquid funds. You can invest through a mutual fund distributor who has obtained ARN from AMFI.

Liquid fund redemption payments are credited to your bank account within one business day. It is known as T+1 day, where T is the day of the transaction.

Benefits Of Investing in Liquid Mutual Funds

A liquid mutual fund is an open-ended scheme that invests in the money market and debt instruments, such as government securities and bonds, with a tenure of 91 days or less. Investing in a liquid fund has the purpose of reducing the risk of interest rate volatility.

- Minimal Risk

A liquid fund is a low-risk debt investment in the Potential Risk Category of BI. As a result, the value of a liquid fund is relatively steady throughout numerous market interest rate cycles. Because of their short investment duration, liquid funds are very liquid. The shorter investment time also eliminates the chance of your money being affected by credit rating swings.

- Quick Redemption

In a liquid fund, you get the requested redemption amount within a day (T+1 Day settlement). Because liquid funds are invested in highly liquid securities with minimal risk of default, this is conceivable. You also have more options for investing, growing, and getting dividends.

- Alternative Of emergency fund

A liquid mutual fund is beneficial since it may be used to pay unexpected expenses or to park any excess investment earnings. Different mutual funds have different limits in their plan policy documents. The normal liquid fund, on the other hand, matures after 91 days. You can invest in your chosen fund through SIPs or as a single-sum investment.

- Low cost

Because liquid funds are not actively managed like other debt funds, they are low-cost debt funds. Traditionally, most liquid funds have very low-cost ratios. Using this low-cost structure can improve the effective return to the investor.

- No lock-in period

There is no lock-in time for liquid money, which may be removed within 24 hours upon request. You can withdraw money before 3 p.m. every business day. If a withdrawal request is made after that time, it will be processed by next business day. There is no entry fees, and exit loads on liquid funds are zero after 7days of investments.

- Taxation on Liquid Funds

Investors earn dividends and capital gains from liquid funds. Investors must pay tax on dividend income from mutual funds. Also, mutual funds pay a dividend distribution tax before disbursing the dividend. Therefore, receiving dividends from a liquid fund is not a good option.

If an investor earns a capital gain by redeeming the fund units at a price higher than their purchase price, the capital gains are taxable.

Short-term capital gains: If an investor sells or redeems the units of a liquid fund after a holding period of up to 3 years, they are deemed to have earned short‐term capital gains. This is taxed at the income tax slab rate applicable to the investor.

Long-term Capital Gains Tax: If a liquid fund is redeemed/sold after being held for over three years, the capital gain is treated as a long-term capital gain and the investor benefits from “indexation.” This means that the purchase price is increased to adjust for inflation (using an index provided by the Government) before calculating the capital gain. Long-term capital gains are currently taxed at a rate of 20%.

Who should invest in liquid funds?

Here are some specific situations when you may consider investing in liquid mutual funds:

- Short-term investment objectives: If you have short-term investment objectives such as saving for a vacation, down payment for a house, or a major purchase, liquid mutual funds can be a good investment option. Since liquid funds invest in short-term debt instruments, they offer higher returns than savings accounts, and are less volatile than other types of mutual funds.

- Emergency fund: It is always a good idea to have an emergency fund in place to cover unexpected expenses such as medical bills, job loss, or car repairs. Liquid mutual funds can be a good option to park your emergency fund as they offer high liquidity and can be easily redeemed within 24 hours.

- Idle cash: If you have surplus cash lying idle in your savings account, investing in liquid mutual funds can be a good way to earn higher returns without compromising on liquidity.

- Stabilizing portfolio: Liquid mutual funds can also be used as a tool to balance out the risk in your portfolio. For instance, if you have a portfolio consisting of equity mutual funds or other risky assets, you can allocate a portion of your portfolio to liquid mutual funds to reduce overall risk.

Disclosure & Disclaimer

Mutual Fund investments are subject to market risks; read all scheme-related documents carefully.