“From Temptation to Triumph: A Guide to Smarter Investment Beyond Past Returns in Mutual Fund”

“From Temptation to Triumph: A Guide to Smarter Investment Beyond Past Returns in Mutual Fund”

Chasing the Past Returns

Let’s face it: chasing past returns in mutual funds is like trying to win a marathon by starting at the finish line. It’s tempting, especially during bull runs, but ultimately leads to frustration and missed opportunities. This article highlights why past performance doesn’t guarantee future success and guides you towards a smarter, more enjoyable investment journey.

Even we, the mutual fund distributors (MFDs), also wish that you get high investment returns. If the market is giving such returns, why not? The problem comes when the investor wants to put new money into the highest-performing scheme of their portfolio at the peak of a bull run. In another variation, they may want to invest in the best-performing scheme of their friend’s/partner’s portfolio. Star-rating chasers, who are past returns chasers too, always want to invest in 5-star rated schemes. They check with us why the schemes in their portfolio are all not 5-star rated. Risk tolerance, asset allocation, and diversification principles are all thrown out of the window or ignored as non-existent.

This note is more about the investors’ phenomenon of ignoring the paths of lesser pain as much as the perils of chasing past returns. Past returns are not expected to repeat in the future. Every seasoned investor knows this truism. It’s in the very nature of capital markets. If not, there is no mean reversion. The returns of a scheme are bounded by the returns on investments of underlying securities. In the short term, when the market remains irrational, someone is willing to pay a very high valuation to a stock or sectors or a group of stocks. This irrational exuberance will be corrected over a period. If the prices of stocks keep increasing indefinitely, there will be no correlation between the growth of the economy and the growth of the values of underlying shares.

The Golden Middle Path

Let’s look at another critical and more destructive investor behaviour. It’s well-known that India’s households prefer to keep their financial assets ‘invested’ in bank deposits. Although the first mutual fund in our country was launched as early as 1964, mutual funds are not the preferred investment vehicle for crores of households. One of the ways to measure the popularity of an investment instrument or system is to express its value as a percentage of GDP. So, as of the end of 2022, the percentage of mutual fund AUM to GDP stands at a measly 16.2%. According to RBI data, as of January 13, 2023, time deposits (including FDs) with banks stood at Rs 164 lakh crore. The corresponding AUM of mutual funds is approximately Rs.51 Lakh Crores. The fixed deposit corpus managed by the banks is more than three times bigger than the mutual fund AUM. The AUM to GDP ratio of many developed countries, such as the US and the UK, stands much higher than India’s.

After getting an idea about the data, let’s look closely at the behaviour of the investors once again. Here’s how the phenomenon of chasing past returns hurts investors. Today’s winners are most likely not tomorrow’s winners. Some could be, but no one will know ahead. Similarly, a scheme that didn’t do well in a particular cycle in the past has a high probability of bouncing back when the economic cycle changes or the fund manager makes suitable changes to the portfolio.

Based on my professional experience of 18 years of distributing mutual funds to various strata of society, I can say with more confidence that most investors (in terms of numbers) think investing in mutual funds is akin to betting. The majority of household investors are happy to keep using low-yielding and tax-inefficient bank fixed deposits as a preferred investment vehicle, if they decide to invest in mutual funds, they expect low or no risk coupled with very high returns (like what happened in the recent past when they either have stayed out of mutual funds or had a small investment.) The ask for the low-risk + Very High Returns combo is impossible to achieve. Nevertheless, that’s what they wish to have.

When you combine the two behaviours, that’s (a) chasing the past returns mindlessly and (b) considering what should be a lifelong process of saving and investing as some betting, it’s a recipe for disastrous at best and sub-optimal returns at worst. Let’s call these investors directionless for the sake of the fluid expression of a severe disorder.

Data Speaks for You

Let’s look at the data, which shows a range of possibilities of decent returns with better downside protection, which are commonly ignored by these directionless investors to whom the investment process is a binary – Conservative or Betting.

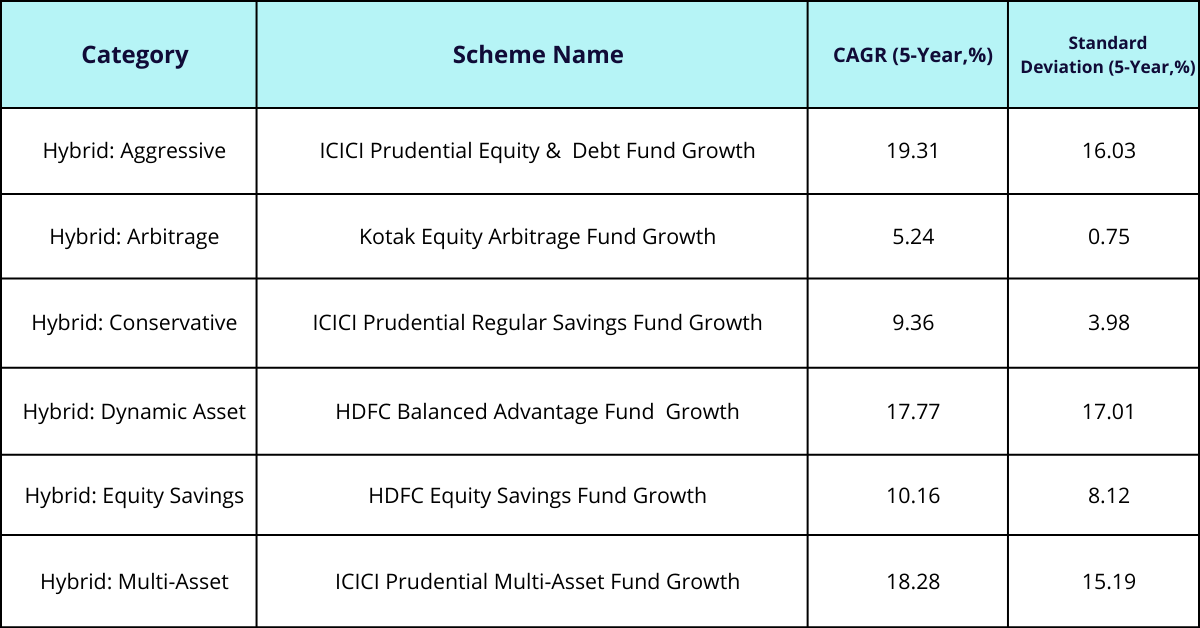

Here are some representative schemes of respective scheme categories and their 5-year returns (CAGR) and Risk parameters (Standard Deviation).

The above schemes belong to the hybrid mutual fund schemes with varying allocations to equity, debt, gold, and other assets. We have selected the 5-year period to avoid highlighting those schemes that belong to these categories currently but were in different categories before five years.

What Can You Observe?

Well, the data is self-evident and tells you,

a) The 5-year CAGR of these schemes are pretty attractive.

b) Even more attractive are the standard deviation numbers, which give quite a comfort for such investors who worry about short-term volatilities and the effects of long-lasting drawdowns.

c) The CAGR range is neither very conservative nor aggressive, nor are the standard deviations.

Why Chasing Past Returns is a Recipe for Disaster

· It ignores risk: When everyone’s jumping into yesterday’s hottest fund, they often forget about risk tolerance and asset allocation. Today’s winner might not be tomorrow’s, and unthinkingly chasing returns can expose you to unexpected losses.

· It’s short-sighted: Markets are cyclical. What goes up must come down (and vice versa). Focusing solely on past gains ignores the bigger picture and sets you up for disappointment when the tide turns.

· It breeds unhealthy comparisons: Don’t get caught up in the “keeping up with the Joneses” game. Comparing your portfolio to others leads to emotional investing and ignores your unique objectives, time horizon and risk appetite.

The Joy of the Middle Path

Instead of chasing fleeting trends, here’s why embracing a balanced approach can transform your investment experience:

- Peace of mind: By focusing on long-term goals and diversifying your portfolio, you can weather market ups and downs with reduced stress and anxiety.

- Realistic returns: Ditch the impossible dream of overnight riches. Opting for consistent, predictable returns through well-researched funds lets you plan for your future confidently.

- Tax efficiency: Stop feeding the tax monster! By avoiding frequent churning and choosing tax-efficient funds, you keep more of your hard-earned money working for you.

- Time is your friend: Don’t let fear and greed dictate your decisions. Stick to your timelines, and allow time and CAGR to work magic.

Remember: You’re not alone! At Prokens Opesmetrics, we have nearly two decades of experience guiding investors towards finding a mutual fund portfolio of suitable schemes. We believe in creating suitable mutual fund portfolios that balance risk and reward, helping you achieve your objectives without stress.

Ready to ditch the FOMO and embrace a joyful investment journey? Contact us today, and let’s chart your path to success!

Tags:

Search

Categories

- Bonds & Fixed Deposits

- Insurance

- Mutual Funds

- "From Temptation to Triumph: A Guide to Smarter Investment Beyond Past Returns in Mutual Fund"

- Debt Mutual Fund

- Equity Mutual Fund

- How to earn good returns

- Liquid Mutual Fund

- Systematic Investment Plan (SIP) in Mutual Fund

- Systematic Transfer Plan (STP) in Mutual Fund

- Systematic Withdrawal Plan (SWP) in Mutual Funds

- Others

- PMS

- Stock Broking