Search

Categories

- Bonds & Fixed Deposits

- Insurance

- Mutual Funds

- "From Temptation to Triumph: A Guide to Smarter Investment Beyond Past Returns in Mutual Fund"

- Debt Mutual Fund

- Equity Mutual Fund

- How to earn good returns

- Liquid Mutual Fund

- Systematic Investment Plan (SIP) in Mutual Fund

- Systematic Transfer Plan (STP) in Mutual Fund

- Systematic Withdrawal Plan (SWP) in Mutual Funds

- Others

- PMS

- Stock Broking

How to earn good returns in mutual funds? (Series Post #2) – Mutual Fund Returns Are Variable.

How to earn good returns in mutual funds? (Series Post #2) – Mutual Fund Returns Are Variable.

Click here: How to earn good returns in mutual funds (Series Post #1).

Mutual Fund Returns are variable.

In the previous post, we saw that different investors would have different return expectations. The range is quite broad, from conservative, to very aggressive. Some investors may also ask for or expect bizarre and unrealistic rates of return. In general, it can be said that investors like high returns and low variability. Mutual fund schemes, however, will do what they usually do.

What’s the variability of returns? You always have the long-term average (mean) rate of return for each type of asset. In my previous post, I called this ‘Easy Part’ of the conversation about returns. The mean return is a highly smoothened number.

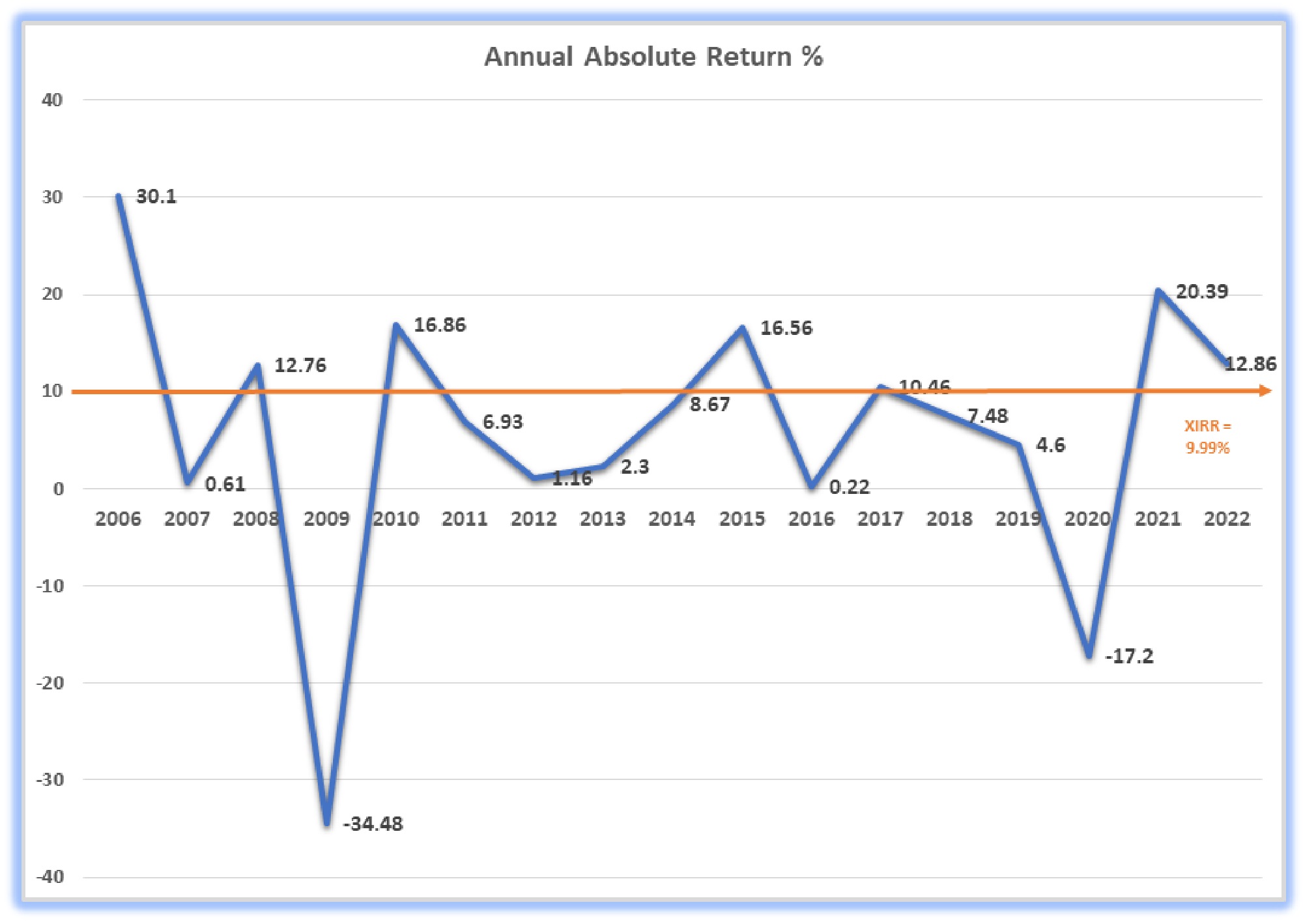

In the above example, the long-term smoothened Extended IRR (XIRR, or mean return in a way) is 9.99%, represented by the straight orange line parallel to Y-Axis. The zagged blue line, which represents the annual financial-year absolute return, shows the portfolio was highly volatile in its 17 years journey. It had two significant drawdowns of -34.48% and -17.2% in 2009 and 2020, respectively. In only one year (out of 17), the annual return at 10.46% was close to the long-term smoothened XIRR.

In the above example, the long-term smoothened Extended IRR (XIRR, or mean return in a way) is 9.99%, represented by the straight orange line parallel to Y-Axis. The zagged blue line, which represents the annual financial-year absolute return, shows the portfolio was highly volatile in its 17 years journey. It had two significant drawdowns of -34.48% and -17.2% in 2009 and 2020, respectively. In only one year (out of 17), the annual return at 10.46% was close to the long-term smoothened XIRR.

The rate of return of a scheme or portfolio often varies from the long-term average. The range of variation can become highly agonizing and even unpalatable to many investors, especially when there is turmoil in the capital markets and negative news flows are at their peak.

Mutual Fund investments are subject to market and other risks. There can be neither a guarantee against loss resulting from an investment nor any assurance that the objective will be achieved. The value of your investments can go up or down because of various factors that generally affect the capital market, such as changes in interest rates, government policy, and volatility in the capital markets. Pressure on the exchange rate of the Rupee may also affect security prices.

Different schemes in a mutual fund portfolio are likely to deliver different rates of returns at different time points if an investor stays invested sufficiently longer. One scheme will display varied return ranges in its sojourn through various economic cycles. Let’s be clear. A mutual fund portfolio or a scheme is likely to generate negative returns, even when the schemes fall under the “very conservative” risk category.

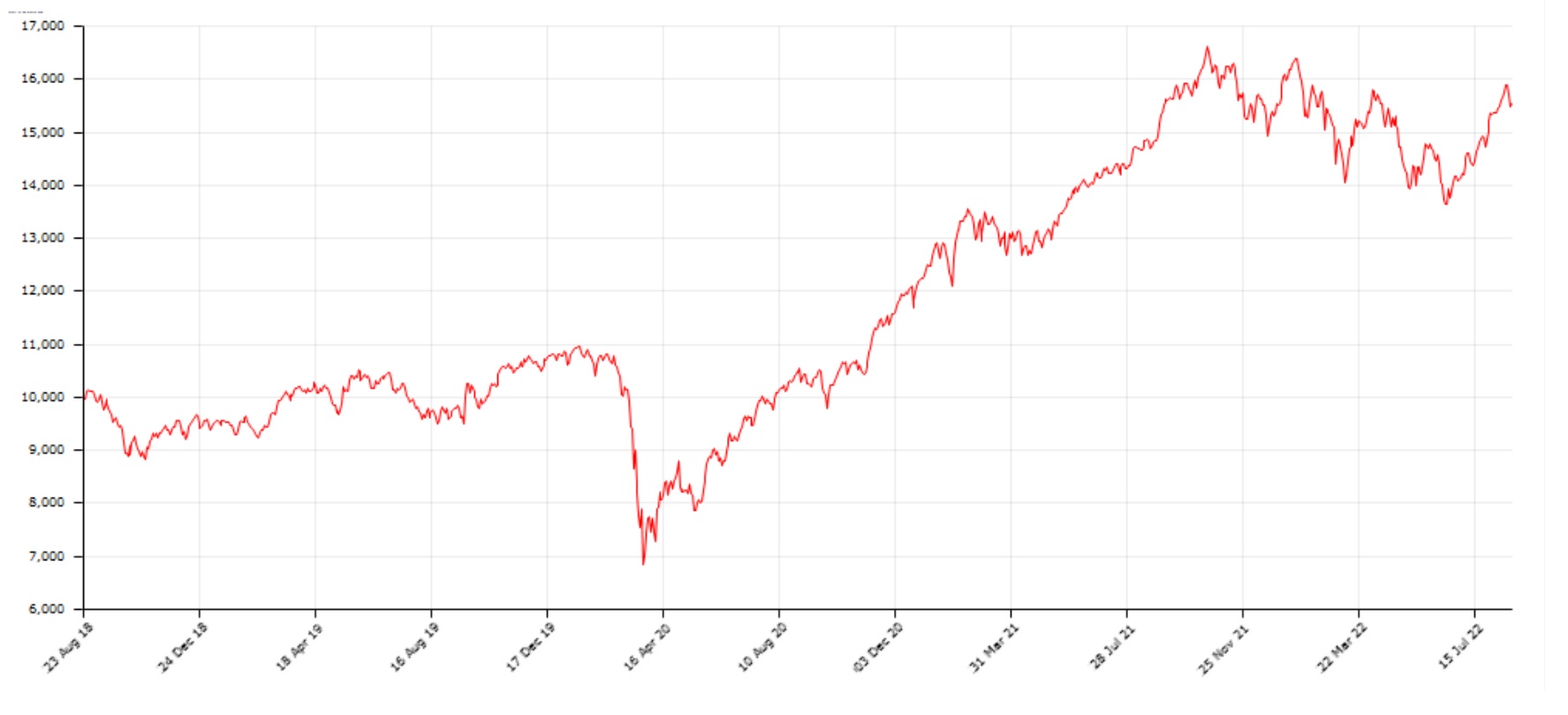

Here is a popular large-cap scheme’s Net Asset Value (NAV) Growth chart.

Rs.10,000/- invested in the scheme on 22/08/2018 didn’t earn any returns for almost two years. At some point in time, the value of the investment fell to Rs.6,544/-, a drawdown of -34.56%! It’s difficult for others to imagine how the investor would have felt at that precise time.

This kind of variability in returns spooks many investors, especially first-timers. Because of the “snake bite effect,” such investors might stop investing if there is no handholding. The value of a mutual fund scheme or a portfolio may remain less than the original investment if the capital market linked to such schemes faces distress. Even a seasoned investor is likely emotionally swayed if the volatility becomes very high and remains so for a long time. A mutual fund distributor’s job is to recommend a suitable portfolio to first-time investors. Since neither the investor nor the distributor can control the happenings in the capital market, the best option is to be aware of the risks and the nature of returns of a mutual fund scheme or a portfolio.

Therefore, understanding the nature and sources of return while investing in mutual fund schemes is vital for all investors. The process gets complicated at least by thirty-seven times. Why? Because, at the last count, there are thirty-seven regulator-designated categories of mutual fund schemes in India (reference date 31st May 2022.)

In addition to the categories, each scheme has different plans and options. There are various modes of investing – lump sum, systematic investment plan (SIP), and systematic transfer plan (STP). When a mutual fund portfolio is sufficiently old, it’s possible to calculate many types of returns such as ‘Since Inception Return,’ ‘Holding Period Return,’ ‘Realised Gains,’ ‘Unrealised Gains,’ ‘Actual Return’, ‘Notional Return,’ ‘Return on existing Units,’ and the list will go on. So, you see, the good return has many names.

With experience, I can confidently say that many mature investing individuals and families prefer to take balanced levels of risk and are happy with the commensurate returns. They belong to what’s technically known as the ‘moderate’ category of risk-takers, based on a global standard risk tolerance evaluation tool. Due to the longer time horizon, persistence, focus on investment objectives, and the power of compounding, the investors, are very successful in their endeavors. This set of investors seems to disprove the naïve theory that investing in mutual funds is only about earning maximum returns. They are more focused on achieving their target investment objectives than chasing returns. They are happy with the ‘moderate’ long-term returns they are earning. They have understood the dynamics of investing in mutual funds well and are leveraging the system to their advantage. Therefore, can we call this ‘moderate’ rate of return a ‘happy’ one? Well, reckless drivers may not like such a denomination, but who are they to take away the happiness of these successful and contended investors?

While I humbly dedicate this story to all my beloved investors, it’s also essential that I share the science of mutual funds with a larger audience and help a little to increase the level of numeracy. In a series of posts, I will explain to the best of my abilities the nature, source, and possible sizes of returns while investing in mutual funds. I will make all jargon easy for you to understand with examples. So, sit back, relax, and enjoy reading. Most of all, let’s have some fun as well.

Are you interested to know more about investing in mutual funds? Get in touch with us here.