Search

Categories

- Bonds & Fixed Deposits

- Insurance

- Mutual Funds

- "From Temptation to Triumph: A Guide to Smarter Investment Beyond Past Returns in Mutual Fund"

- Debt Mutual Fund

- Equity Mutual Fund

- How to earn good returns

- Liquid Mutual Fund

- Systematic Investment Plan (SIP) in Mutual Fund

- Systematic Transfer Plan (STP) in Mutual Fund

- Systematic Withdrawal Plan (SWP) in Mutual Funds

- Others

- PMS

- Stock Broking

How to earn good returns in mutual funds (Series Post #3) – Mutual Fund Returns are mostly Capital Gain.

How to earn good returns in mutual funds (Series Post #3) – Mutual Fund Returns are mostly Capital Gain.

Click here: How to earn good returns in mutual funds (Series Post #1)

Click here: How to earn good returns in mutual funds? (Series Post #2) – Mutual Fund Returns Are Variable.

In this article, we will learn another aspect of the return.

The return from a mutual fund is mostly capital gain.

Even after fifteen years, it takes me a lot of time and effort to make a new investor understand how she can earn returns when investing in mutual funds. Especially to those who are used to keeping their money ‘safe’ in bank fixed deposits, it’s bewildering to see no entries in their mutual fund’s statement of account at the end of every quarter showing a credit of ‘interest.’ It takes some time for the investors to get used to the reality that the return in their mutual fund portfolios is always in terms of the increasing value of their investments (aka “Current Market Value”).

Due to the variability of the return, the Current Market Value keeps changing daily. It will blasphemously fall below the investment amount many a time. I will hear a cry of panic if such a thing happens in the early years of investing time horizon, say, in the first year or two. Everyone invests to make money, and here’s the situation where the portfolio value has fallen lower than the original investment. So, let’s understand how the returns are earned when investing in mutual funds, even before knowing how to make ‘good’ returns.

Let’s start with the basic answer first. The return from a mutual fund scheme is generally defined as the increase in the scheme’s Net Asset Value (NAV) plus the amount given out under the “Payout of Income Distribution cum Capital Withdrawal (IDCW) option.”

That is,

Return = Increase in the Scheme’s NAV + IDCW.

Of course, choosing IDCW is an option.

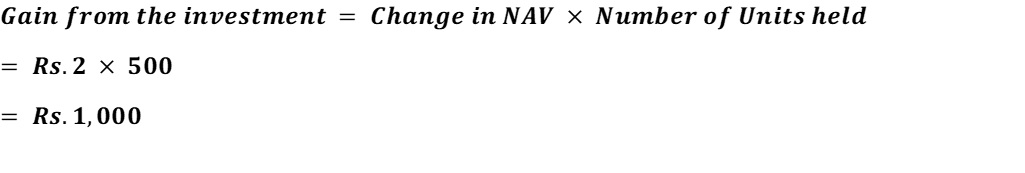

Let’s illustrate the calculation with a numerical example:

Suppose, on 1st April 2021, you invest Rs.5,000 in the XYZ scheme in the growth option. The Net Asset Value (NAV) of each unit of the scheme on 1st April 2021, let’s assume, is to be Rs.10.

So, you will own Rs.5,000 ÷ Rs.10 = 500 units of the XYZ scheme.

On 31st March 2022, you will find that the NAV of each XYZ scheme unit has increased by Rs.2 and stands at Rs.12.

So, this is how we calculate the returns of this investment:

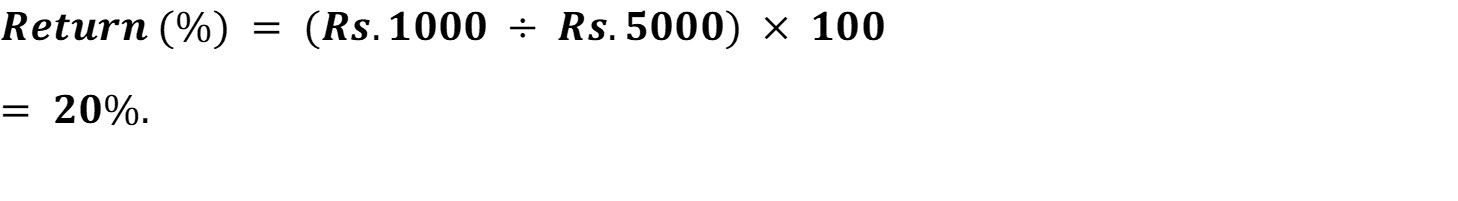

Now, you can express this gain in percentage by dividing the gain by the original value of the investment and multiplying by 100.

Now, you can express this gain in percentage by dividing the gain by the original value of the investment and multiplying by 100.

As this return is earned over one year, exactly, it will also be known as an ‘annual return.’ The return (or gain) is not in your hands (or bank account) yet, because you haven’t sold the units. Hence, it’s unrealized capital gain. Unrealized gains will not lead to tax incidence; therefore, the return is gross of taxes.

Under the Growth option of a mutual fund scheme, there will be no income distribution, and the return to investors will be only by way of capital gains through redemption at the applicable NAV of Units.

What’s “Income Distribution cum capital withdrawal” or “IDCW”?

It’s the new name assigned by the regulator for the money distributed to the unit holders from the distributable surplus if the investor has chosen such an option. Earlier, it was known as “dividend.”

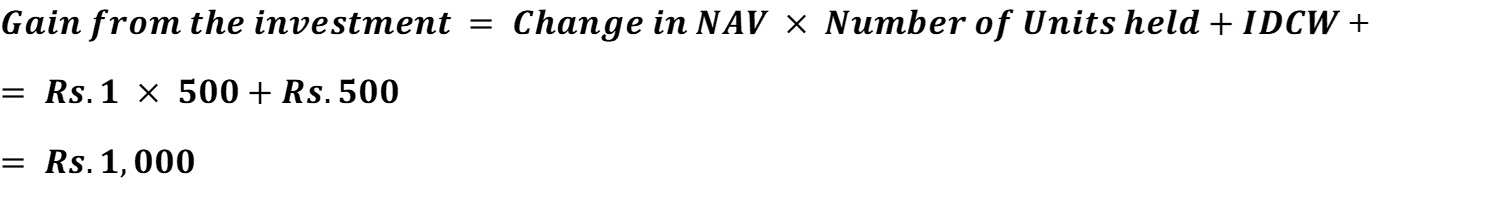

Now, let’s tweak the previous example a little bit.

Suppose, on 1st April 2021, you invest Rs.5,000 in the XYZ scheme in the IDCW option and Payout Plan. The Net Asset Value (NAV) of each unit of the scheme on 1st April 2021, let’s assume, is to be Rs.10.

So, you will own Rs.5,000 ÷ Rs.10 = 500 units of the XYZ scheme.

On 31st March 2022, you will find that the NAV of each XYZ scheme unit has increased by Rs.2 and stands at Rs.12.

Suppose the fund manager decides to distribute to the unit holders Rs.1 per unit from the distributable surplus.

So, this is how we calculate the returns of this investment:

|

Record Date |

31/03/2022 |

|

Dividend Rate (Rs.) |

1 |

|

Cum NAV on record Date |

12 |

|

Total Units |

500 |

|

Total Dividend (Rs.) |

500 |

|

Dividend out of capital (Rs.) |

0 |

|

Dividend out of appreciation (Rs.) |

500 |

|

Ex IDCW NAV (Rs.) |

11 |

Now, you can express this gain in percentage by dividing the gain plus IDCW by the original value of the investment and multiplying by 100.

As this return is earned over one year, it will also be known as an ‘annual return.’

Part of this return (or IDCW) is in your hands (or bank account), and the gain part is still not in your hands because you haven’t sold the units. Hence, it’s an example of income receipt (IDCW) plus unrealized capital gain. Unrealized gains will not lead to tax incidence; therefore, that part of the return is gross of taxes.

Currently, dividends distributed by a mutual fund are taxable in the hands of investors as per applicable tax rates.

The illustration is given to understand how the gain of a scheme occurs, and it should not be construed as an indicative return of any mutual fund scheme. Mutual fund investments are subject to market risk. Please read all scheme-related documents carefully before investing.

Are you interested to know more about investing in mutual funds? Get in touch with us here.